Government Loans

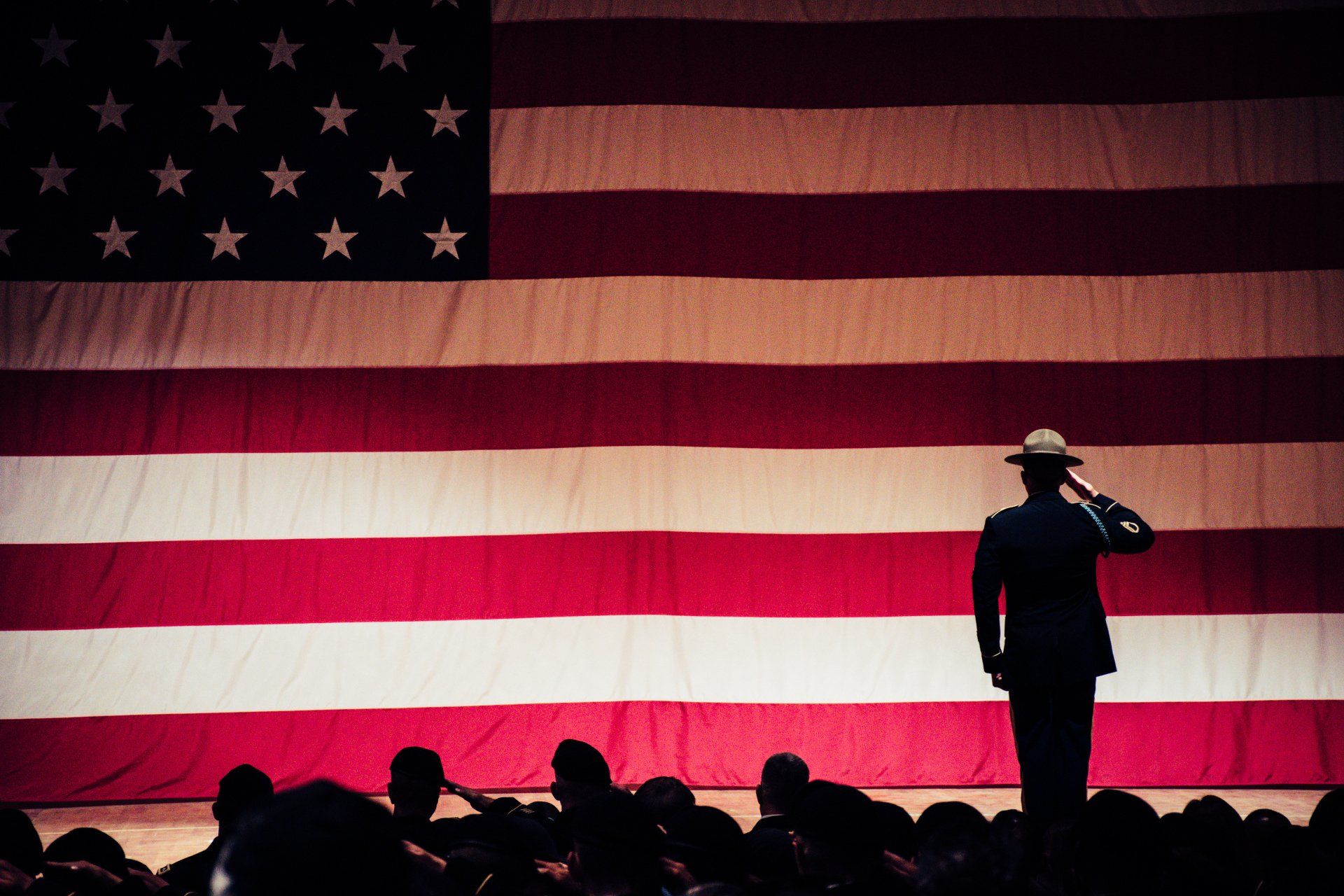

Venture into the world of accessible homeownership with the supportive foundations of FHA, USDA, and VA loans, each designed to make your path to owning a home smoother and more attainable. Together, FHA, USDA, and VA loans encompass a broad spectrum of opportunities, ensuring that the dream of homeownership is accessible to a diverse range of buyers, from those stepping into their first home to those serving our country.

How Our Home Loan Process Works

The Easy 4 Steps

STEP 1

Contact us for your complimentary home loan analysis. Our experts are committed to offering you a detailed assessment that highlights the best rates and terms tailored to your unique financial situation.

STEP 2

Receive options based on your unique criteria and scenario. With this personalized analysis, you'll gain insights into how you can maximize your savings and make informed decisions about your home purchase or refinance.

STEP 3

Compare mortgage interest rates and terms. By taking into account your unique circumstances, we help you identify the most cost-effective rates and favorable terms, simplifying the decision-making process.

STEP 4

Choose the offer that best fits your needs. Once you've identified your ideal mortgage, our team will assist you through the application process, ensuring a smooth transition towards securing your home loan.

DOWN PAYMENT ASSISTANCE FINANCING

Are you having trouble saving for a down payment? Tired of paying rent but don’t think you can afford to purchase a home? You could be eligible for local and state down payment assistance programs that may cover part or all of your down payment and any additional closing costs. Talk to a loan officer today for a complimentary home loan evaluation to determine if you are eligible.