Bank Statement Loans

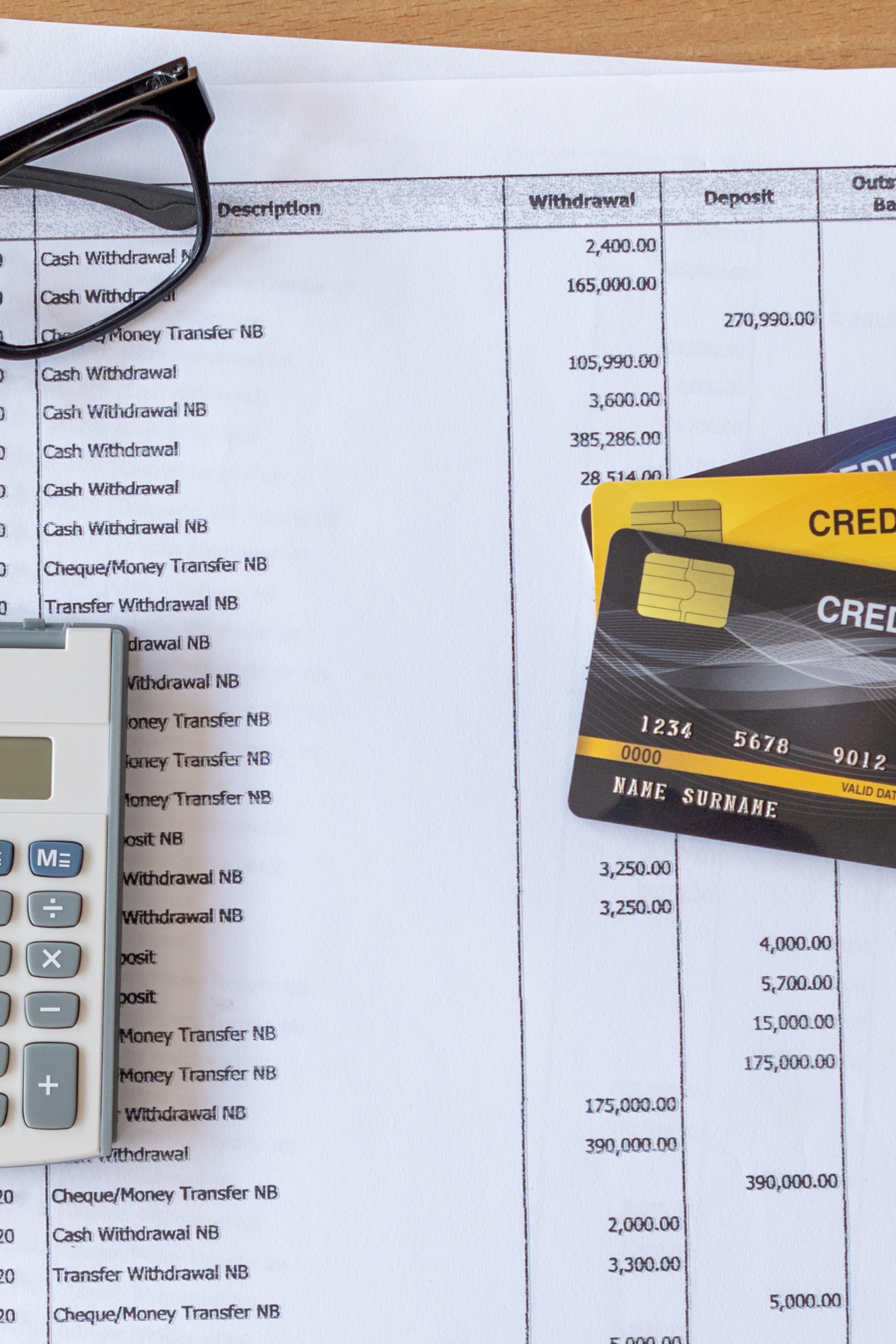

At Lifestyle Lending, we offer Bank Statement Loans designed for self-employed individuals, freelancers, and business owners who want to purchase or refinance a home without the constraints of traditional mortgage requirements. Unlike conventional loans that rely heavily on W-2s and tax returns, Bank Statement Loans use your bank statements—typically 12 to 24 months’ worth—to verify income based on your deposits.

This makes it an ideal option for those with non-traditional income streams or variable earnings. Whether you’re buying your dream home or refinancing an existing property, our Bank Statement Loans provide the flexibility and personalized support you need to achieve your goals.

Why Choose a Bank Statement Loan?

Why choose a Bank Statement Loan through Lifestyle Lending? It’s a game-changer for borrowers who may not fit the mold of standard financing due to irregular income or limited tax documentation. If you’re a gig worker, entrepreneur, or independent contractor, this loan lets you qualify based on your real cash flow, not just what’s reported to the IRS.

Our clients appreciate the simplified process, faster approvals, and the ability to secure competitive rates without jumping through unnecessary hoops. Let Lifestyle Lending help you turn your financial reality into homeownership with a Bank Statement Loan tailored to your unique lifestyle.

How Our Home Loan Process Works

The Easy 4 Steps

STEP 1

Contact us for your complimentary home loan analysis. Our experts are committed to offering you a detailed assessment that highlights the best rates and terms tailored to your unique financial situation.

STEP 2

Receive options based on your unique criteria and scenario. With this personalized analysis, you'll gain insights into how you can maximize your savings and make informed decisions about your home purchase or refinance.

STEP 3

Compare mortgage interest rates and terms. By taking into account your unique circumstances, we help you identify the most cost-effective rates and favorable terms, simplifying the decision-making process.

STEP 4

Choose the offer that best fits your needs. Once you've identified your ideal mortgage, our team will assist you through the application process, ensuring a smooth transition towards securing your home loan.

GET STARTED WITH YOUR BANK STATEMENT LOAN TODAY!

Take control of your homebuying journey with a Bank Statement Loan from Lifestyle Lending. Whether you’re self-employed or simply need a more flexible financing option, our team is ready to make it happen.

Request your free, no-obligation quote today and discover how easy it is to qualify for a loan that fits your life!